- Andrzej Krajewski

On 20 January, Donald Trump will officially take over the reins of the White House. In the eyes of many, he is a politician capable of unpredictable moves that threaten the very foundations of the Western world.

These include NATO and the certainty that the US will not abandon Europe, especially when it is in need. Meanwhile, the new president's political motto is 'America First', and he has a simple message for Europe's allies: either you take responsibility for your own security and future, with all the costs that entails, or there will be no more alliance. Meanwhile, Europe, mired in a myriad of problems, has few arguments to counter Trump's hardball game.

At a time when China is greedily taking over more and more of the world's industries and America is attracting companies and professionals, EU countries are fighting a drain of capital, companies and talent. Speaking of the state of the old continent, we sounded the alarm bell more than once. Today, we try to put the record straight and, using hard data, identify six of the European Union's biggest weaknesses that could prove fatal.

Trump's simple messages continue to shock the political elite in Western European countries, opinion leaders and the media. They are met with fear and disbelief. This state of mind was brilliantly described by Simon Kuper in the Financial Times in an essay entitled 'Europe's fear of the outsider'. The writer urges readers to 'Imagine a people living their best lives on an island in about 1800. They have no enemies. They don’t need to work long hours. The gentle waters around them are full of fish. One day, giant ships appear carrying hostile outsiders. They have superior technology, including magical firing weapons! Picture the islanders’ panic. Today’s Europeans are like those islanders. Suddenly, stronger, unfriendly outside forces — notably, Russia, China and Donald Trump’s US — threaten from all sides.' Kuper describes. In the face of new threats, Europeans feel ‘paralyzed,' he adds.

It is hard to argue otherwise when it comes to the emotions currently felt in Western Europe. But while the new occupant of the White House is an unconventional negotiator, his previous tenure has shown that he sees the world through the prism of business. When he meets someone on the other side who accepts his rules of the game and is able to make an interesting offer, the mutual relationship begins to warm up considerably.

From the start of his campaign in April 2014. In addition to China, Trump also attacked Japan. Early on, he wrote on social media. We let Japan sell us millions of cars without paying import taxes, and we can't make a trade deal with them. He then recalled how, two decades earlier, Japan had almost become the world's biggest exporter at the expense of the United States. He also promised to make Tokyo pay dearly for the guaranteed economic benefits and military protection it had enjoyed from the US since the end of the Second World War.

After Trump's victory in 2016, panic set in the land of Cherry Blossom. After all, the United States was the main provider of security. This fact became particularly relevant in an era of China's increasingly expansionist policies. At the same time, Japan was weakening as a result of years of economic malaise and a rapidly ageing population. That’s why, Prime Minister Shinzō Abe took numerous measures to prevent the threats that Trump had used during the election campaign from coming true. Abe's main objectives were to maintain the military alliance with the US and prevent a tariff war.

Analysing his actions, columnist Jio Kamata pointed out in the pages of The Diplomat magazine: "Abe managed to restrain Trump's worst instincts by convincing his counterpart that pursuing his own national interests and respecting those of his allies are not incompatible.

At the same time, he has been extremely skilful in adapting to his partner's tastes. He was one of the first to visit Trump at his private residence immediately after his election, ignoring the displeasure of Barack Obama, who was still in office. He then became a passionate golfer, willing to spend hours with Trump on the golf course. He ate hamburgers with him and flattered him. He even suggested that he wanted the new president to be nominated for the Nobel Peace Prize.

It is widely believed that Abe's charm offensive against Trump has worked. - Jio Kamata says. US commentators and international leaders share this assessment. The fact that Trump publicly recalled his time with Abe with tenderness - in contrast to some world leaders who angered him - is some evidence that he considered Abe a trustworthy person whom he respected,' Kamata points out. As a result, in the years that followed, the White House did nothing to impede the Japanese auto industry's access to the US market, which remained crucial to the industry. What's more, new trade agreements were signed that lowered tariffs on food and digital products, covering some $55 billion worth of goods.

The alliance between Washington and Tokyo remained strong.

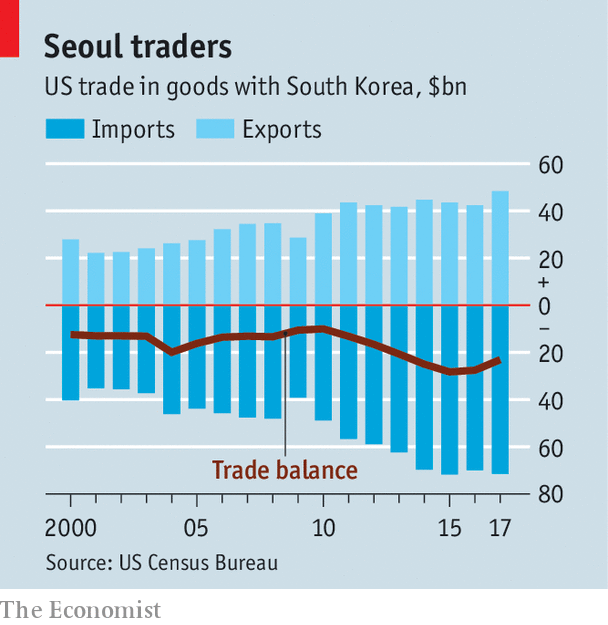

The relationship between Washington and Seoul has been somewhat different. South Korea's ruling president, Moon Jae-in, proved to be less adept than Prime Minister Abe. While Trump was obsessed with the cost of stationing US troops on the Korean peninsula. Aware that the US military is Seoul's only outside guarantee of security against the North Korean threat, he pressured President Moon Jae-in to agree to a fivefold increase in the Korean side's annual contribution to the cost of US military care. This meant an increase from $924 million to $5 billion. At the same time, he forced Seoul to renegotiate the KORUS Free Trade Agreement, which came into force in 2012. In this way, Trump sought to reduce the trade deficit with the US's seventh largest trading partner.

Moon Jae-in defended his country's interests by only partially meeting Trump's demands. For example, Seoul started paying more for the US military presence, but not as much as $5 billion, and the amount now stands at $1.47 billion a year. It also agreed to voluntarily reduce its steel exports to the US by 30 per cent. It accepted a quota of so-called free imports from the US of 50,000 cars and vans, exempt from South Korea's strict technical and environmental standards. All they have to do is meet the standards set by law in the US. At the same time, Moon Jae-in took on the role of mediator in organising a face-to-face meeting between Trump and North Korean leader Kim Jong Un. After all, it had become the US president's ambition to bring lasting peace to the Korean peninsula and get the communist regime to give up its nuclear weapons. Trump wanted to kill at least two birds with one stone. To relieve the United States of the cost of guaranteeing peace in this region of Asia and to secure a Nobel Prize in the process. It was awarded to Barack Obama at the beginning of his presidency as an incentive to secure world peace. The fact that the next US president has a similar dream and also wants to be rewarded for actual achievements was recognised by Moon Jae-in alongside Prime Minister Abe. In a speech at the Blue House in Seoul on 27 April 2018, standing on the podium next to the US leader, the South Korean president stated bluntly: "It is President Trump who should receive the Nobel Prize. We just need to embrace peace. These words were greeted with barely concealed satisfaction by the American guest.

It is no coincidence that the United States' relations with Japan and South Korea during Donald Trump's first term in office are presented here. It should be noted that both countries were in a strategic situation even worse than that of European countries today. Their economic development is closely linked to access to the US domestic market, to which they export their main products. They are also under constant pressure from their aggressive nuclear-armed neighbours, China and North Korea. Thus, only the military presence of the United States, with an arsenal capable of deterring potential aggressors, guarantees their secure existence and postpones the prospect of war. Despite their weak negotiating position, they have managed to maintain a close alliance with the theoretically unpredictable Trump. But first they had to go through a period of difficult, anxiety-provoking negotiations. But after enduring pressure and aggressive rhetoric from Washington, platforms for compromise were found.

Moreover, the agreements reached were not overly burdensome for either Seoul or Tokyo. Trump's business approach resulted in many detailed provisions in the trade agreements that guaranteed US companies a better position and higher profits. But this did not mean excessive losses for the other side. The skill and personality of the chief negotiator, i.e. the head of state, also proved very important. In the case of Prime Minister Shinzō Abe, disputes that seemed to threaten the alliance were not only resolved, but the alliance was actually strengthened. Therefore, the widespread view that Donald Trump's unpredictability and radical policy shifts pose the greatest threat to the European Union may be misplaced. Once the theatrical gestures and radical verbal attacks of the new US president have been swallowed, the way will remain open for modifying the relations between the US and the countries of the European Community. There will then be a kind of test of the political talents of the individual leaders of the EU countries. With a visible end result in the form of a new relationship with Washington. The best negotiators will not only have nothing to lose, but may even gain a great deal for their country, following the example of Prime Minister Abe.

The greatest danger lies elsewhere, and its within the European Union itself. The changes currently taking place in the United States are beginning to act as a great accelerator, speeding up what is happening in Europe. The early elections in Germany and the deepening political crisis in France are only the first symptoms. This accelerator of change will have an impact regardless of how conciliatory Trump is towards the Old Continent. It’s becoming increasingly clear that he will start tearing at the seams holding Europe’s decades-old community together.

In this case it will be very helpful to identify what, for the sake of order, we will call 'areas of weakness in the European Union'. Six have been identified for the purposes of this material.

Outlining them will give us an overview of the EU's current situation, make it easier to assess and help us understand why its condition is crumbling. And the seams that hold the European Union together are creaking ever louder.

The Escape

So let us begin our journey by tracing the EU's weaknesses. Politico's chief European correspondent, Matthew Karnitschnig, has been down this road before. Karnitschnig was nominated for two Pulitzer Prizes for his coverage of the collapse of Lehman Brothers in 2008 and the ensuing financial crisis, followed by the eurozone debt crisis in 2011. All signs point to a third opportunity for him to compete for the coveted award. In an article published by Politico before Christmas, Karnitschnig wrote: "With Donald Trump poised to retake the White House in a few weeks and the continent’s economy in a deepening funk, the bedrock on which the region’s prosperity rests isn’t just developing fissures, it’s in danger of crumbling.”

According to the man who closely followed the two biggest and most dangerous economic crises to hit the West in the 21st century, the growing tensions between Washington and Beijing herald difficult times for European economies. This will be exacerbated at the start of Trump's administration, when he will begin to use tariffs as a tool of blackmail to force trade deals favourable to the US, while protecting US industry.

“If Trump follows through on his threat to impose tariffs of up to 20 percent on imports from the continent, European industry would suffer a body blow. With more than €500 billion in annual exports to the U.S. from the EU, America is by far the most important destination for European goods.” says Karnitschnig. Trump's demands that NATO countries increase their defence spending will make matters worse.

This means that European countries, which are already struggling with rising deficits and falling tax revenues, will face even greater financial challenges, which could trigger new political and social upheavals, predicts Karnitschnig. But he adds something that goes to the heart of the matter: 'Though the EU is focused on Trump and what he might do next, when it comes to Europe’s economy, he’s not the real issue. If Europe had a more solid economic foundation and were more competitive with the U.S., Trump would have little leverage over the continent.”

Europe is rapidly losing those solid foundations. So let's focus on the first of the "weaknesses" mentioned, namely the flight of the most valuable companies from Europe and the increasingly weakened state of those that have not yet fled or are unable to do so.

Until recently European companies approaching the US market just used to open subsidiaries there. But the phenomenon of total relocation is growing year by year.

Founded in Sweden in 2006, the start-up Spotify gave a whole generation of young people the opportunity to easily stream music from the internet. It has since grown to 640 million users worldwide. Thanks to this, it generated $13.25 billion in revenue in 2023. Under the leadership of Daniel Ek, the company has been gradually moving its operations to the US for several years. This strategy began to bear fruit this year. Spotify's market capitalisation has reached $94.5 billion and its share price is breaking new records.

Similarly, in the US, the startup Sword Health, founded in Portugal in 2015 by Virgílio Bento and Márcio Colunas, has been praised. The company, which combines AI and physiotherapy guidance in a novel way, has raised $130 million in funding after moving its headquarters to the US and is now thriving. This is reflected in its market valuation of around $3 billion.

Such examples can be multiplied. According to a survey by the German Chamber of Industry and Commerce (DIHK), around 37% of industrial companies with more than 500 employees - out of a total of up to 3,300 - plan to reduce or close production in Germany by 2024 and relocate abroad. A year earlier, the figure was 31 percent.

The German company Meyer Burger, until recently Europe's largest manufacturer of solar cells, is a good example of what this process looks like in practice. In mid-2023, the company's management sent a letter to Finance Minister Christian Lindner threatening to build another factory not in Germany but in the US. They warned that with the package of laws being prepared by the Joe Biden administration, the Inflation Reduction Act (IRA), they could count on very generous subsidies on the other side of the Atlantic. The state government of Saxony and the federal government expressed their understanding, and that was the end of it.

In response, the company announced that it would invest in the US, but reassured that its plants in Saxony-Anhalt and Saxony were not at risk of closure.

Subsequently, in March 2024, Meyer Burger announced the closure of its Freiberg plant and the redundancy of around 400 employees. The reason given was the inability to compete with low-cost solar cells sold in the EU by Chinese manufacturers. At the same time, the company, which reported a loss of US$365 million in the first half of the year, was desperately trying to start production at two new plants in Goodyear, Arizona, and Colorado Springs, Colorado, by the end of 2024. However, this was not proving to be so easy.

“We are doing everything in our power to strengthen the company and establish it as a reliable premium supplier in the USA," wrote Meyer Burger's management in a special letter to concerned shareholders. They were reassured by the information that the company would benefit from the support guaranteed by the IRA. It communicated: 'Loan agreements are currently being negotiated'.

If Meyer Burger survives the turbulence and catches its second breath by relocating production to the US, then the German government should expect to see the end of photovoltaic manufacturing in its home country. Something that was supposed to be one of the key industries in the assumptions of the European Green Deal, generating profits and jobs, is ending its existence on the old continent. In order to survive, it will have to move to the United States, where it will generate the expected profits and jobs and pay taxes. The people of Europe, on the other hand, will be left with abandoned factory buildings and the option of buying photovoltaic panels made in the USA if they do not want to buy those made in China.

To get an idea of how fast the process of relocating companies, especially in the industrial sector, from Europe to the US or the Middle Kingdom can go, it is worth looking at the report 'Revitalising American Manufacturing'. It was prepared by the National Economic Council (NEC) for the White House and made available in October 2016.

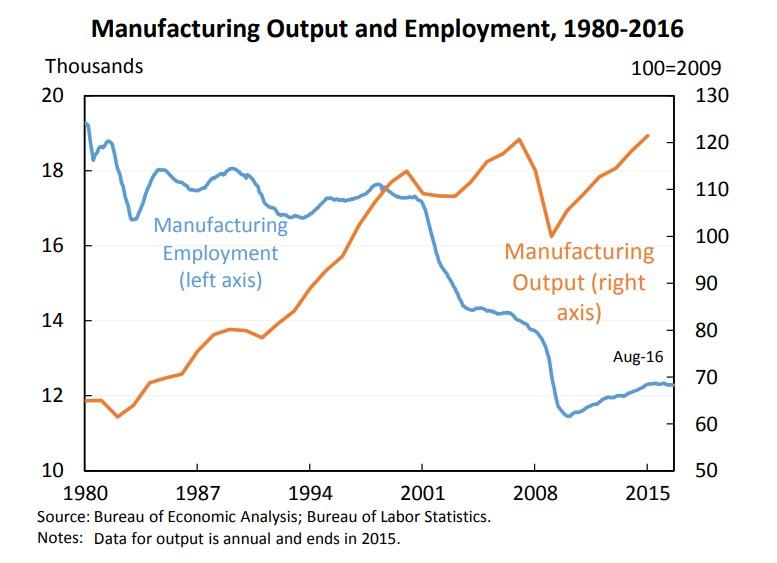

While the document is not about Europe, it gives an idea of how quickly the relocation of key industries can happen in the modern world, given the right circumstances. The report states that the existential crisis of US manufacturing began in 2001. By 2009, 5.7 million of the 17.3 million manufacturing jobs had disappeared. As the NEC reported to the White House: 'This was a higher percentage of jobs lost than during the Great Depression (1929-1935). Tens of thousands of factories were closed during that period, including 40 per cent of our largest factories with more than 1,000 workers. By the end of the Great Recession, factories were empty and most of our capacity was idle, with the vacancy rate nearly doubling from 5.1 per cent in 2000 to nearly 10 per cent in 2009.

The report 'Revitalising American Manufacturing' makes several things clear. In less than eight years, the US lost almost half of its major manufacturing facilities before the government even responded. Most of this manufacturing capacity has been moved by US investors to China, which has increased its power. The shift threw at least a dozen million Americans who had been able to consider themselves middle class into poverty. The Rust Belt was born. And finally, the radicalisation of public opinion brought Donald Trump to power and forced the entire Republican Party to move sharply to the right.

If we look at the European Union, the analogous process may be even faster and deeper. The result is a boiling 'rust belt' stretching from northern France and northern Italy through Germany to Poland.

The state of the Old Continent's car industry supports this thesis. After announcing plans to close at least three factories in Germany, slash tens of thousands of jobs and cut wages by 10 per cent, Europe's biggest carmaker, Volkswagen, is facing union protests. Its management is openly demanding state aid and threatening to move production to China. The agreement reached at the end of the year states that all production sites will be maintained. However, production capacity in Germany will be reduced by around 734,000 vehicles, with the loss of 35,000 full-time jobs. In addition, production of the Golf and Golf Estate models will be transferred to Puebla, Mexico.

Other automotive companies such as Ford, Continental and Bosch, have recently announced major job cuts in Europe. The Stellantis group, created in 2021 by the merger of Fiat Chrysler Automobiles and Groupe PSA, is in increasingly bad shape. The Franco-Italian-American group has already seen its net profit fall by 48% in the first half of 2024. And the outlook for the coming months is even worse.

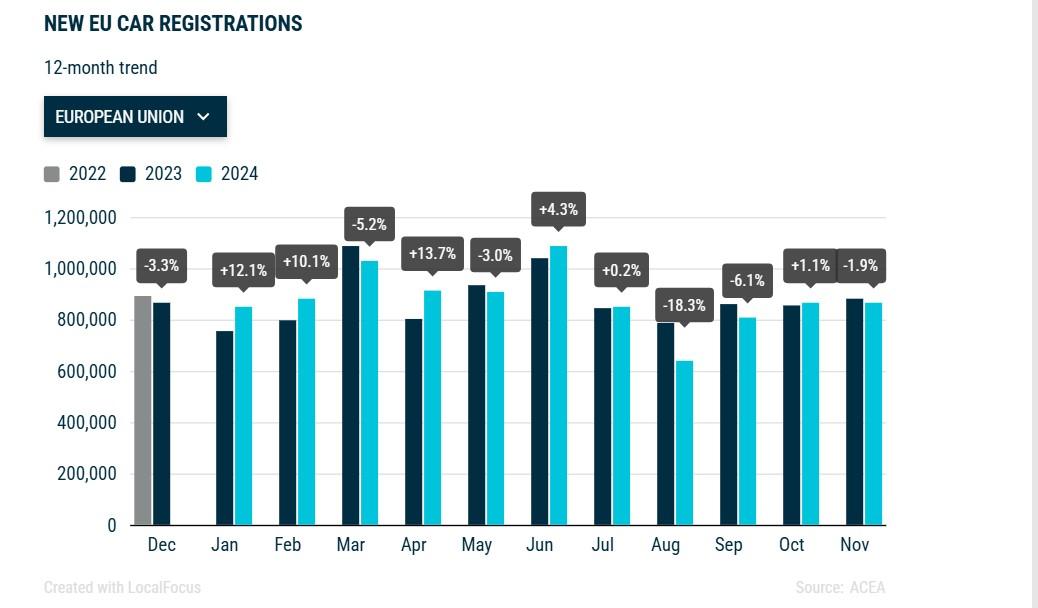

This is despite the fact that the European car market has been stagnating rather than collapsing for several years. It is only in the second half of 2024 that sales fell sharply in successive months.

In November 2024, France led the way with a 12.7 per cent drop in new car registrations compared to the same month in 2023. Italy was second on the podium with a fall of 10.8 per cent.

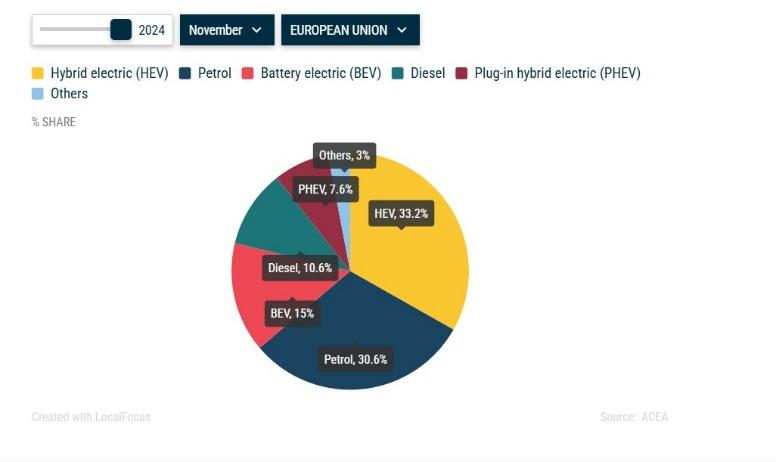

There are also no signs that the project to replace internal combustion engines with electric cars will be a quick success. With government subsidy programmes being cut back, there is a collective retreat from electric cars in the EU. Registrations of pure EV cars fell by 9.5% in November 2024 compared to the previous month. The situation is worst in the largest EU countries. In Germany, the drop was 21.8% and in France it was as high as 24.4%.

Compared to the same month last year, sales of electric cars fell by 5.4 per cent. This is important because a ban on the registration of new cars and vans powered by engines that emit CO2 (internal combustion engines powered by so-called 'zero emission fuels' are allowed) is due to come into force in the EU in 10 years' time. Meanwhile, the number of electric cars has reached only 15 per cent of new cars sold each year. And this share is expected to fall.

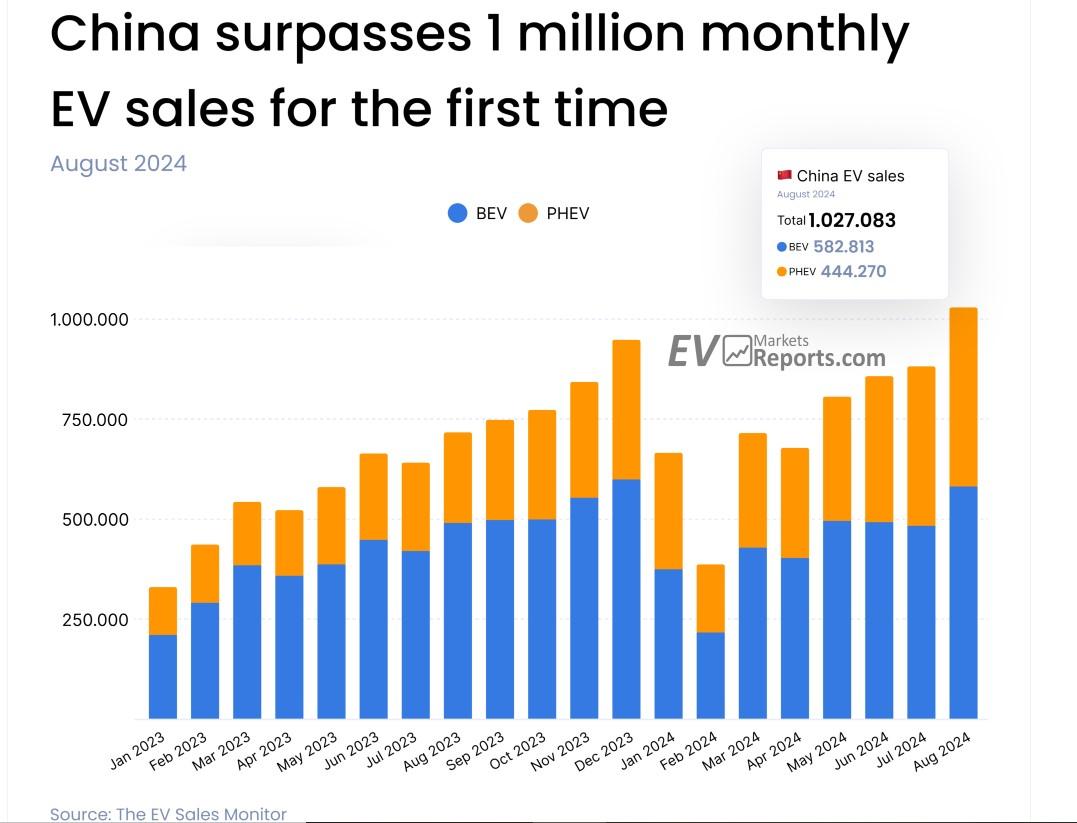

This raises the prospect that the hitherto large and rich European market could shrink year by year. And eventually shrink many times over! If even a moderate drop in sales can cause such disruption, it means that the tsunami is only just beginning. And it could wipe out most of the car companies on the old continent. All the more so as they begin to suffer increasingly painful defeats in the seemingly most promising market - China.

Before the pandemic, up to 25 per cent of new cars sold in China were produced by German companies. After the pandemic, only 15 per cent were produced by German companies, and by 2024 it was no longer a decline but a slaughter.

By the third quarter of 2024, Volkswagen's sales are down 15 per cent year-on-year, and BMW's are down 30 per cent. Mercedes is still holding on, with a 13 per cent drop, but its management has revealed that profits from the Chinese market have halved. Customers in the Middle Kingdom have turned massively away from German brands in favour of domestically produced cars. And especially electric and hybrid cars. Monthly sales of such vehicles in China are up to a million units. Meanwhile, the pride of the German automotive industry, the Mercedes EQE electric car, did not find a single buyer in China in October 2024, despite a price cut!

If Donald Trump now imposes tariffs on the European car industry, the threat of disaster hangs over the entire German economy and beyond. No wonder that the President of the European Commission, Ursula von der Leyen, announced in January that she would 'open a dialogue' with the entire automotive industry, trade unions and industry associations to work out plans for the future. This announcement on 19 December was accompanied by a biting commentary in the German daily Bild. It said: 'Now that competitive pressure from the US and China is increasing, the inventor of the ”Green Deal' is abandoning her unchanging climate mantra and making the car crisis a top priority.”

The sudden change of policy by the head of the European Commission is as rational as it can be. Let us recall what Gabor Steingart wrote in Focus magazine on 15 July 2023 (quoted): "The German car industry will collapse, Germany will collapse. At least Germany as we know it". But this fatalistic prognosis does not only apply to Germany. In the Union, the car industry is crucial to the economies of: the Czech Republic, Slovakia and Hungary. It is of considerable importance to: Poland and Spain (for more on this topic, see Germany has a (car) problem. And so does the whole of Europe).

And there is something else that Matthew Karnitschnig highlighted in the pages of Politico, namely: "The dirty little secret of European R&D spending is that half of it comes from Germany. And most of that investment flows into one sector: automotive.” After which the author specifies that: "In 2003, the top corporate investors in R&D in the EU were Mercedes, VW and Siemens, the German engineering giant. In 2022, they were Mercedes, VW and Bosch, the German car parts-maker. “

There has been no major flow of research and development funds into sectors such as smartphones, integrated circuits or artificial intelligence over the last twenty years. As a result, the financial resources of EU countries and European companies invested in development over the years have been diverted to an industry that is now dramatically losing global market share to companies from China, but also the US, Japan and S.Korea. Karnitschnig sums up the situation with the classic investor's adage about putting all your eggs in one basket.

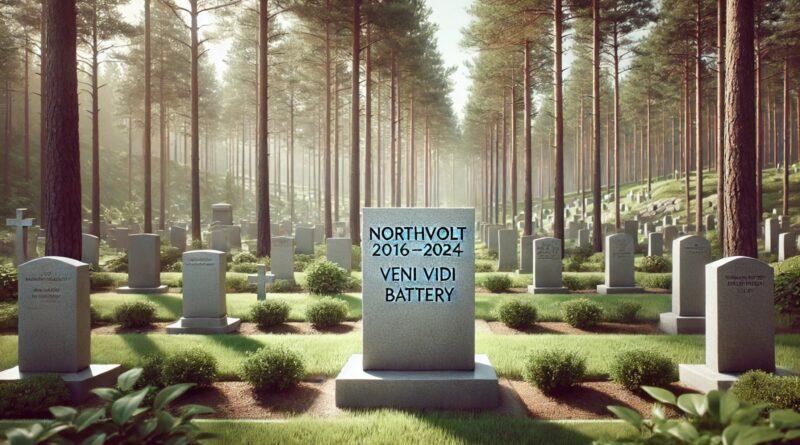

The collapse of the European car industry is also toppling more dominoes. In Germany and France, ambitious plans have been launched in recent years to revive the Chinese-dominated energy storage market. In the long term, this industry appears to be more strategically important than preserving Europe's last remaining solar cell and wind turbine manufacturers, which are also gradually being wiped out by Chinese competition. (For more on this topic, see Resources: How China is beating Europe at its own (green) game).

Large-scale energy storage is a highly desirable element in stabilising renewable energy systems. When it comes to the development of electromobility, batteries are a key component of any vehicle. The rapid development of AI also requires security in the form of energy storage. A number of ambitious investment plans have been launched in Germany and France to create gigafactories in Western Europe to ensure domestic production of energy storage. However, the collapse of the electric car market in the EU has led to a sharp drop in demand for batteries. Demand for car batteries fell by 69 per cent in Germany, 40 per cent in Italy and a 33% in France. As a result, the Automotive Cells Company (ACC), whose shareholders include Stellantis, Mercedes-Benz and its subsidiary TotalEnergies, has halted the construction of two of its three planned gigafactories. Even though, €4.4 billion has been raised to finance the investment. The gigafactories in Kaiserslautern, Germany, and Termoli, Italy, will therefore not be built. Thanks to support from the French government, only the Billy-Berclau plant was able to be completed earlier and start production.

The EU's best hope to compete with the Chinese, the Swedish company Northvolt, is also part of this trend. It is the only company in Europe to have developed its own sodium-ion battery project, which offers the chance to build cheap energy storage on a large scale. This enabled the company to secure loans and grants, including from the European Investment Bank (EIB), to an impressive $15 billion. Two battery factories were quickly built in Sweden and one in Poland. Northvolt also began to invest in Germany, the USA and Canada. Meanwhile, BMW cancelled an order worth €2 billion. Then, in September, CEO Peter Carlsson revealed that the Swedish company's annual turnover was a measly $128 million. That meant a loss of $1.2 billion. At a time when sales of electric cars in the EU are collapsing, European battery companies are failing in the face of competition from Chinese products.

To save itself from the consequences of its loss of liquidity, Northvolt filed for protection from creditors in a US court on 21 November. This gives it one last chance to restructure its massive debts. As reported by Reuters on 20 December 2024, Northvolt's lawyer told a court hearing in Houston that the company had approached more than 100 potential lenders and investors in search of new financing to enable Northvolt to complete its restructuring. Meanwhile, the Gdansk plant has already been closed.

Northvolt misdiagnosed the situation. They thought there would be a huge shortage of batteries because no one would be able to scale up to meet demand. Instead, China increased production to five times Northvolt's forecast,' explains Michael Barnard, strategic director of Trace Intercept Ltd. He adds that Northvolt's batteries were too expensive and that the company made no effort to reduce production costs.

In the current situation, Northvolt's best chance of survival lies with its spun-off subsidiary Northvolt North America, which has already moved to separate financing and is not subject to bankruptcy proceedings. It can therefore quietly complete the construction of a battery gigafactory in Quebec, Canada.

There is no doubt, therefore, that the most valuable companies are finding it increasingly difficult to survive on 'European soil', to the extent that they prefer to undertake the complicated, costly and painful process of relocating to more fertile ground - the US. This affects the most important sectors of the EU countries' economies. However, this migration is also accompanied by a second weakness: a massive outflow of capital from Europe to the United States.

Financial gravitational field

In an article published in Le Figaro on 29 October, entitled 'The United States, the new Eldorado for French companies', we read: 'The United States has never been more attractive to French companies. Wendel, Lactalis, Amundi, Saint-Gobain, Sanofi, Thales... The list of French flagships that have recently attacked the US market is growing. Since the beginning of the year, they have spent 14.3 billion dollars to establish or strengthen their position in Uncle Sam's country.

In her article in Le Figaro, business journalist Danièle Guinot cites data showing that French companies have been investing more and more in the US over the past three years. In 2024, they have invested 50 per cent more there than the year before. These companies are still in good shape and are not yet planning to move across the Atlantic. However, what they earn in Europe and elsewhere is no longer invested in the old continent but in the US.

The French are no exception. Foreign direct investment in the US totalled USD 289 billion in 2023. This made the US the most popular destination for FDI, accounting for around 26% of the total global investment pool.

This was followed by the first quarter of 2024, when it was reported that $76 billion worth of FDI flowed into the US, 31 per cent more than in the same period a year earlier.

Until recently, the Old Continent appeared to be a more attractive place to invest than the US. Two decades ago, EU countries attracted 33 per cent of global FDI. Now the US has taken over.

In 2023, the European Commission decided to monitor this process. This led to a report that tried to describe it, published in January 2024: "In the period from 2013 to 2022, there have been around 12.800 Merger and Acquisitions transactions by EU companies in third countries corresponding to roughly EUR 1.4 trillion and 26.000 Venture Capital investment transactions with an overall value of EUR 408 million. For both categories the top two destinations where the USA and the United Kingdom, which represented at least half the deals and approximately 70 % of the capital. “ Given the size of the UK economy, it can be assumed that well over 50 per cent of the capital went to the US. Except that the Commission looked at the period before the rapid acceleration that occurred in 2023.

America's pull on the global debt and equity markets is stronger than ever. So far in 2024, foreigners have poured capital into US debt at an annual rate of $1 trillion, almost double the flows into the eurozone,' - Ruchir Sharma, CEO of Rockefeller International, calculated in the Financial Times on 2 December 2024. This is a gigantic inflow of capital into the United States. According to Ruchir Sharma, the US will attract more than 70 per cent of the $13 trillion worth of private investment from the global market in 2024, including foreign direct investment, securities purchases and loans.

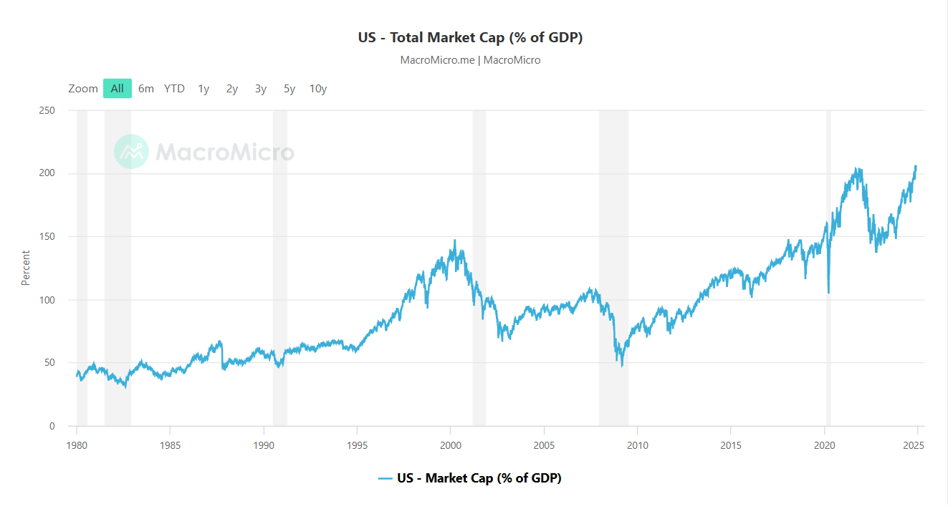

This money goes to Wall Street or the Nasdaq stock market. It has reached the point where the market capitalisation of stocks listed on the New York Stock Exchange is approaching $62 trillion, more than twice the nominal size of the US economy.

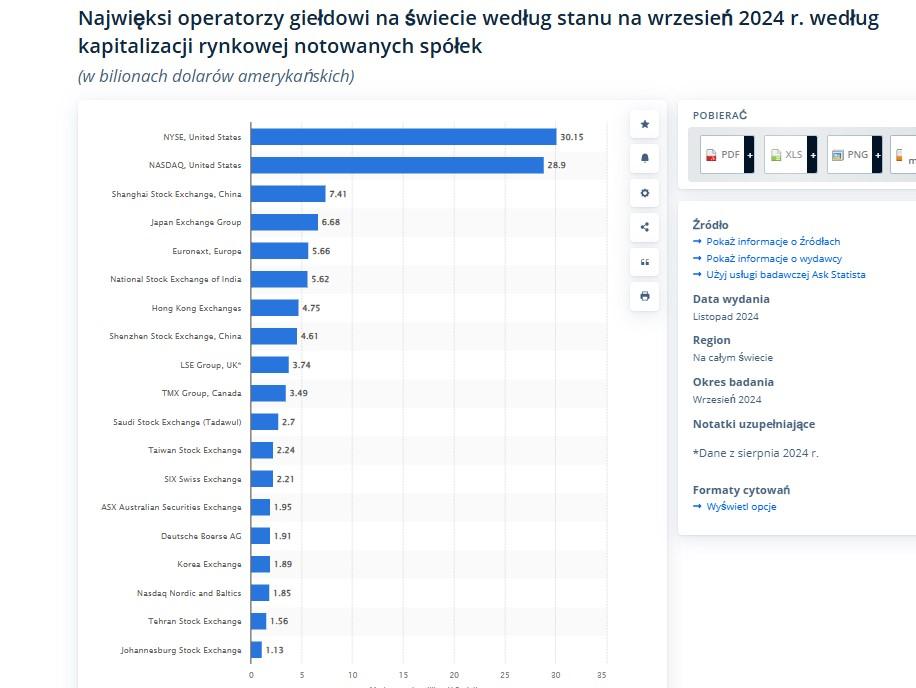

As a result, the US now accounts for almost 70 per cent of the world's leading stock market index, up from 30 per cent in the 1980s. In the current global rankings, two American stock exchanges occupy the top positions by a wide margin, with no close competitors.

And as capital has fled Europe for the USA, more and more of Europe's biggest companies are pulling out of the Old Continent's stock markets and listing in the US. Among those who have done so are the German chemicals group Linde, the Irish building materials group CRH and the Italian engineering group CNH Industrial.

With capital in the US, Europe's best companies will move their listings there, and even more investors and capital from Europe will follow. And the circle closes.

For the time being, the European Commission, in consultation with member states, has decided that by the summer of 2025 an assessment will be made of the risks this process poses to the EU and that "counter-measures for outbound investment" will be developed.

It seems that we are witnessing a self-perpetuating process. As capital becomes increasingly scarce in the EU, it will become more difficult to raise it for promising projects. So start-ups that want to develop will have no choice but to move to the United States. This is already happening. According to an analysis published by the Center for European Policy Analysis (CEPA), Europe is experiencing faster year-on-year growth in new start-ups than the US. However, they are increasingly willing to move outside the EU after a few years of development. There is a simple explanation for this. EU Member States and the EU itself guarantee readily available capital for their creation and early development. In the first quarter of 2024 alone, European start-ups received $13.7 billion in subsidies. But then they hit a wall when they are still not generating profits. To grow to the point where they can start to see growing revenues and eventually profits, they then need much larger injections of capital. That, in turn, is what they are no longer counting on in Europe.

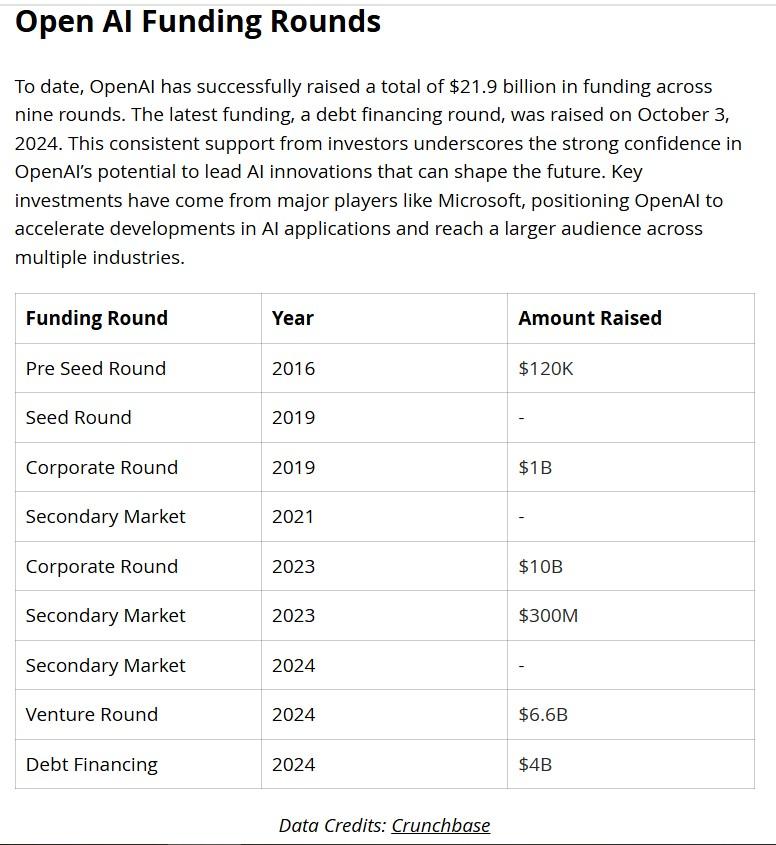

Although Europe is producing a flood of start-ups, US companies are 40 per cent more likely to secure venture capital funding in their first five years," the CEPA report points out. This is why OpenAI, led by Sam Altman, was born and thrived in the US, while nothing similar happened on the old continent. In fact, the start-up easily raised $21.9 billion in subsequent stages of development. And the main backers were private technology and investment companies, such as Microsoft, Thrive Capital, Sequoia Capital and K2 Global.

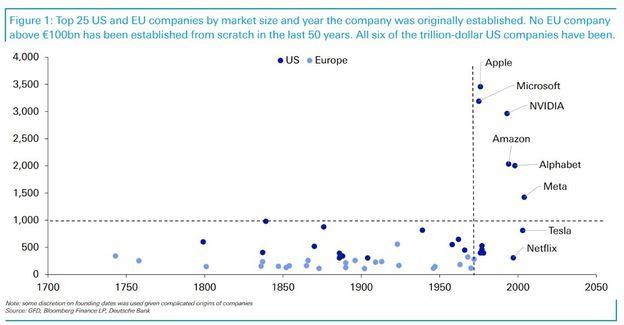

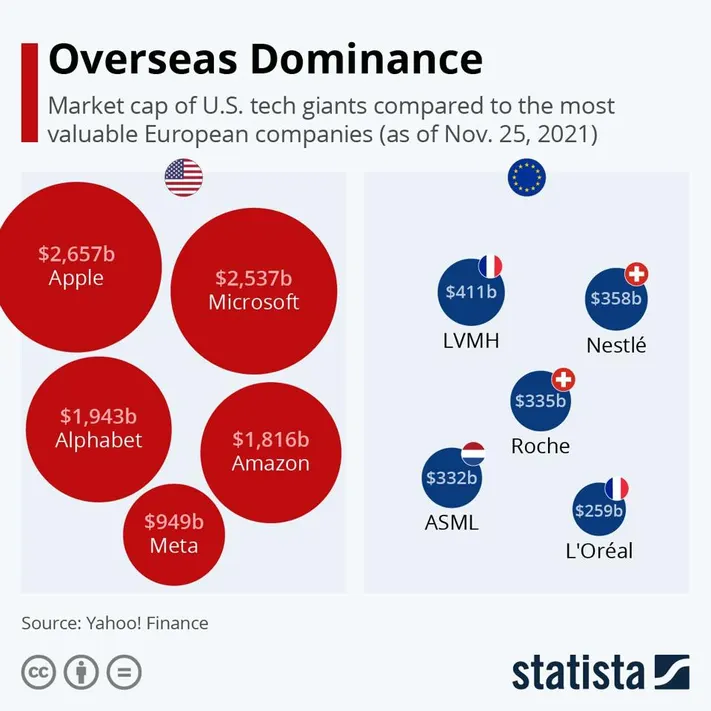

It is hardly surprising, then, that start-ups working with the most advanced technologies have fled Europe. In fact, this process has been going on for years and has been systematically accelerating. But it was only after Mario Draghi's famous report that the alarm was sounded. Among other things, he wrote: "There is not a single company in the European Union with a capitalisation of more than €100 billion that has been created from scratch in the last 50 years. By contrast, all six US companies with a market capitalisation of more than €1 trillion were created in the same period.

More than that, they are shaping the modern world: Apple, Microsoft, Nvidia, Amazon, Alphabet and Meta. They were born in the mid-1990s.

And today, compared to the largest companies on the old continent, they look like sharks compared to minnows.

So when companies and capital flee across the Atlantic, people follow, and these are the best specialists. The brain drain is the "third weakness" of the EU.

The American Dream for Europeans

It was aptly defined in an article published at the end of August 2024 by the online platform Modern Diplomacy. Referring to the mass exodus of start-ups from Europe to the US, it noted that "Silicon Valley and other parts of the country are becoming the main offices of professionals leaving the EU. Fast speeds of brain drain and relocation of promising young companies and specialists cannot avoid affecting the future profits of Europe’s unified capital market.”

Ironically, in this area too, EU countries are taking it upon themselves to finance the economic successes of the United States. Indeed, government spending on 'education' in the EU as a whole amounts to some EUR 746 billion (equivalent to 4.7 per cent of Community GDP). The quality of this education is still relatively high. What is more, at university level, unlike in the US, it is essentially free. As a result, the brightest and best-educated people are migrating across the Atlantic. The impact of this process on economic development is well illustrated by statistics on the number of new patents registered in the US. Over the last decade, more than 22% were filed by expatriates who moved to the US to find jobs in the technology industry or in academia. In the European Union they accounted for only 3 percent of such patents. Interestingly, of this pool of new innovative patents filed by expatriates in the US, 62 percent were the work of migrants from the Old Continent. The intellectual property they create is also proving to be a gateway to material success. A look at the annual Fortune 500 list of the 500 largest US companies reveals that 44 per cent of the firms on it were founded by immigrants or their children.

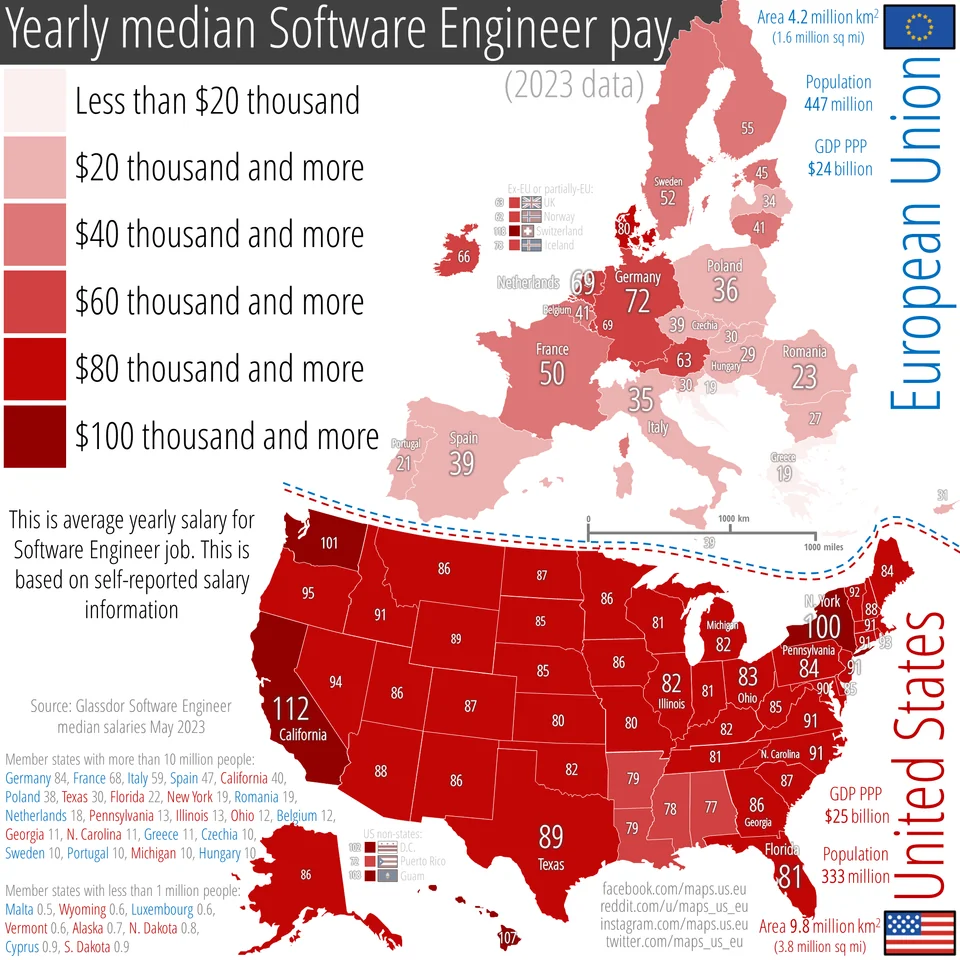

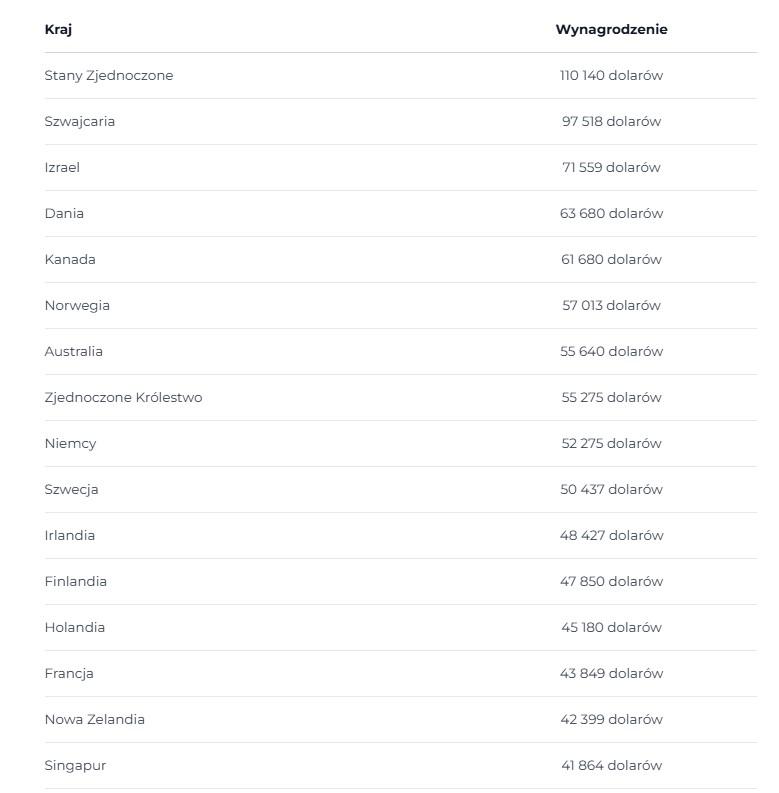

The opportunities and salaries offered are enough to make the US a magnet for the most sought-after professionals from the old continent. Take, for example, the software engineers who are so essential to the modern economy.

According to users of Glassdoor, an online platform that collects data on employers, the average salary for a software engineer in the US in 2023 will be one-third higher than in EU countries.

This gap is set to widen. In 2024, the average annual salary of a software engineer in the US will be $110,140. In the EU's highest-paying country, Denmark, it will be $63,680, in Germany just $52,275 and in France $43,849.

At the same time, this professional could earn USD 167,000 a year in San Jose, in Silicon Valley, or USD 133,000 if he or she chose New York. So if a member of the aforementioned professional group is an excellent software engineer and decides to move across the Atlantic, he or she can de facto expect to earn two or even three times more than on the Old Continent.

A similar pattern applies to other occupational groups, most relevant to today's key industries. The relocation of industry from Europe to the US, and the associated influx of investment and capital, creates this wage gap. This in turn accelerates the brain drain from the Old Continent.

These three types of flight - of companies, capital and people - leave Europe vulnerable, which the determined Chinese are particularly keen to exploit. Helplessness in the face of Chinese economic expansion is the Union's fourth weakness.

China with a visit after 200 years

The video 'How China Conquers Europe via EU's Green Deal?' was entirely devoted to this issue. It told how the key economic flywheels for Europe's Green Deal plans - the production of: batteries, wind turbines, photovoltaic cells, electric cars, etc. - were dominated by the Middle Kingdom. To the exclusion of European manufacturers. A further step in this process could be to try to dominate other industries, making Europe the main market for Chinese products. On the one hand, Beijing is already suffering from overcapacity in its export-dependent industries. On the other hand, a new factor has emerged - Trump. In an article published in November The Financial Times warned: "If Trump continues to threaten to impose 60% tariffs on Chinese exports, Beijing is likely to turn its attention to other regions, such as the EU, which will seek measures to stem the tide. “

Meanwhile, the EU is completely unprepared to resist decisively in the way that the US has begun to do against Chinese exports. When the Biden administration raised tariffs on heavily subsidised Chinese electric cars to 100 per cent in mid-2014, and added a further 50 per cent tariff on batteries for the vehicles, a row broke out in Brussels. Germany and Hungary sought to block a similar move by the European Union. They want tariffs on all electric cars to remain at the level of the EU's standard import duties - i.e. 10 per cent.

For the government in Berlin, it was more important to ensure that any retaliation by Beijing would not affect the interests of the German car industry, which is increasingly dependent on the Chinese market. For Victor Orban, too, closer economic and political relations with the Middle Kingdom proved more important than the economic security of the Union. Admittedly, a coalition of 10 countries led by France and Poland pushed through the decision to impose higher tariffs, while Germany and four smaller countries, including Hungary, were against. But no fewer than 12 countries abstained, afraid to openly offend Beijing's interests. Although the adopted tariffs are the result of a compromise, their level was made dependent on the EC's discretionary assessment of whether a particular electric car company producing in China is Chinese and respects the rules of fair competition. As a result, foreign manufacturers such as Tesla are subject to a 7.8 per cent surcharge (making it in total 17.8 per cent import duty), while China's Geely is considered a 'fair' product (after all, it owns Sweden's Volvo) and is subject to an 18.8 per cent surcharge, while state-owned SAIC is subject to a 35.3 per cent surcharge, making a total of 45.3 per cent tarriff.

But even in the latter case, the tariff barriers are twice as low as those imposed by the United States. Beijing has responded with a series of retaliatory measures, targeting products from the EU countries that voted for the tariffs in the first place.

The Communist authorities are capable of playing brutally and it is in their interest to weaken the Union and deepen the divisions within it so that they can increase their access to a highly attractive market and de facto colonise it. While avoiding the relocation of advanced industrial production to the EU. At a closed-door meeting earlier this year, China's Ministry of Commerce warned domestic carmakers against making major investments in Europe, advising them to set up production lines on the continent only for final assembly," the Financial Times reported in mid-November 2024.

Divisions within the EU are therefore in Beijing's interest, as the split vote shows. The growing contradiction of interests within the EU, especially between Germany and France, its two strongest states, is in fact the fifth 'weakness of the Union'.

Berlin versus Paris

For decades, the two countries that form the backbone of the Community have tried to act in solidarity and reach compromises on the most important issues. And when this happened, the common will of Berlin and Paris became a decision binding on the whole Union. But China's economic expansion and Donald Trump's election victory are increasingly straining this backbone. Germany's economic success has for decades been based on its huge exports, making this relatively small country the world's third largest exporter by global standards. Until recently, it was able to compete effectively with China and the United States.

Berlin's priority therefore remains to maintain free trade at all costs and to seek new markets. France, on the other hand, under Emmanuel Macron, is trying to be the most active in the EU in pursuing its own industrial policy in order to save and rebuild its manufacturing capacity. This in turn means tending towards protectionism and protecting domestic producers. In his speech at the Sorbonne in April 2024, the French president also spoke of the need for joint investment in industry in the EU and a move away from the current rules of free competition. He outlined a vision to create five strategic sectors in the Union: artificial intelligence, quantum computing, space, biotechnology and new energies.

The conflict over the Mercosur agreement showed what this deepening contradiction means in practice. Negotiated for 25 years, the agreement with the South American countries was suddenly concluded overnight. While Michel Barnier's government in Paris was collapsing and President Macron was struggling to maintain control of the French political scene, the President of the European Commission took advantage of her main opponent's moment of weakness. Ursula von der Leyen surprised Paris, but also Warsaw and Rome, by announcing on 6 December 2024, together with the leaders of Argentina, Brazil, Paraguay, Uruguay and Bolivia, an agreement to create a free trade area with a population of 700 million. For experienced German manufacturers and exporters, this is a huge opportunity to take a second breath. Mercosur has no similar agreement with China, so it would be easier for EU companies to find a market. Moreover, South America is a region rich in lithium and rare earths, raw materials essential for the energy transition. This alone is enough to understand the determination of Berlin and the head of the EC. But at the same time, the same agreement is unacceptable to Paris. This was expressed by President Macron on 12 December 2024 at a joint press conference with Prime Minister Donald Tusk in Warsaw. He declared: 'We do not agree with the agreement as it stands, we are certainly not going to sacrifice our agriculture in the name of the mercantilism of the last century'. France, which argues that the Mercosur agreement is binding only on the European Commission and not on EU member states, can count on the support of Poland and several other EU countries. This promises to be a fierce battle for ratification.

Opening up to free trade with South America heralds the greatest benefits for the German economy. In the case of France and Poland, on the other hand, these benefits are also apparent, but they are accompanied by significant costs in the form of a huge threat to domestic agricultural production. This, in turn, will inevitably be accompanied by the outbreak of huge revolts by agricultural producers, probably on an even larger scale than at the beginning of 2024.

On the other hand, the economic forecasts for Germany in 2025 look downright dramatic. At the end of December 2024, the director of the German Economic Institute, Michael Hüther, said in an interview with the DPA agency: 'We have seen many crises in the last 100 years, but none of them has been as complex and had as many causes as the one we are in today.” So 2025 promises to be the third year in a row without significant economic growth for Germany, but with worsening difficulties. It is hardly surprising, then, that Berlin and Ursula von der Leyen have been so obstinate in pushing through an agreement with Mercosur in the EU. But when other contentious issues are added, such as the development of nuclear energy, which Berlin is still trying to block, it becomes clear that the rift between France and Germany can only widen. The Politico noted on 6 December 2024 that such a scenario "threatens to shake the foundations on which the European Union was built" and that the trade treaty itself "will trigger widespread anger against the establishment and the EU".

This, in turn, would open the floodgates to the European Union' s “sixth area of weakness ” and perhaps its last, as it could lead to its end.

Highest stakes game

This will happen if Europeans increasingly associate growing problems, indecision, impoverishment and widespread disorder not only with the incompetence of local authorities, but also with the very idea of the European Union.

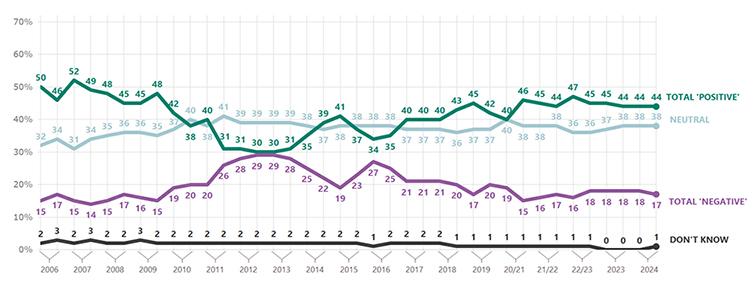

According to Eurbarometer survey conducted in the autumn of 2024, 44 per cent of EU citizens still have a positive view of the Union, 38 per cent a neutral view and 17 per cent a negative view.

Looking at long-term results from the same source, however, we can see that at the height of the eurozone crisis in 2012, the number of supporters and opponents of the EU was equal at 30 per cent. Meanwhile, all the signs are that a storm even more powerful than that of a decade ago is now looming and, given the state of the German economy, could once again shake the foundations of the eurozone.

At such moments, social unrest, voter radicalisation and rejection of the old political elites become natural. As the political class is unable to solve people's problems, they begin to look around for new leaders and parties that can give them hope for a better future. However, it is very likely that these will be radically 'Eurosceptic' forces, such as the AfD, which has written into its draft election manifesto that Germany should leave the eurozone and even the European Union.

Looking at the Community's six vulnerabilities as a whole, we can see that they overlap and reinforce each other. These, in turn, are toppling the dominoes of change.

If the European Union were functioning without the need for economic competition with China and the United States, the process would not be so rapid and brutal. But splendid isolation is impossible. What matters, therefore, is the weakening competitiveness of the Community's major economies and the very poor adaptability to change of the ossified structure that is the EU. So the crisis is growing. It has only been exacerbated by Donald Trump's election victory. To make matters worse, the new president's main objectives are: to strengthen the competitiveness of the US economy by any means possible and for the US economy to regain its dominant position in the world. So the murderous race with the Middle Kingdom - in all areas of mutual competition - will accelerate.

This means that the European Union will come under even more pressure, hitting its "weak spots". Even if Donald Trump does not intentionally harm the EU in his next steps, the seams that hold it together will start to creak badly. And in a way that has never been seen before.

Sources:

- https://www.ft.com/content/49af4164-3ab2-42e0-a422-f6a050f2f002

- https://www.vox.com/2015/6/23/8826245/donald-trump-japan-peril

- https://thediplomat.com/2024/11/was-the-abe-trump-bromance-a-real-thing/

- https://www.automotivelogistics.media/policy-and-regulation/us-japan-trade-deals-ignore-automotive-tariffs-for-now/39332.article

- https://quincyinst.org/research/the-u-s-south-korea-alliance-toward-a-relationship-of-equals/#summary

- https://www.economist.com/finance-and-economics/2018/09/27/the-trade-deal-between-america-and-south-korea-has-barely-changed

- https://www.voanews.com/a/experts-future-of-us-south-korea-defense-cost-sharing-deal-remains-uncertain-/7819599.html

- https://www.cato.org/free-trade-bulletin/trumps-first-trade-deal-slightly-revised https://pism.pl/publikacje/Perspektywy_polityki_mi_dzykorea_skiej_Moon_Jae_ina-korea-us-free-trade-agreement#conclusion

- https://www.npr.org/sections/thetwo-way/2018/04/30/607008627/trump-should-win-the-nobel-peace-prize-south-korea-s-moon-says

- https://www.politico.eu/staff/matthew-karnitschnig/

- https://wiadomosci.onet.pl/politico/ue-stala-sie-pustynia-innowacji-i-nieudacznikiem-apokalipsa-gospodarcza-w-europie/9k99jsh?utm_source=livebar&utm_campaign=newsy_sg

- https://en.wikipedia.org/wiki/Spotify

- https://www.musicbusinessworldwide.com/key-spotify-executives-have-cashed-out-more-than-1-billion-in-stock-this-year-including-283-million-for-daniel-ek/

https://en.wikipedia.org/wiki/Sword_Health - https://www.yahoo.com/tech/3-billion-startup-sword-health-185246330.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAFHovlFOuklDj3brGBx_d7NecqLqBtbD8VlLdn14x3pI3BxxjjSqX4YRv-FJks9lLv1bGdzN6Rs0rHafOPx9Qbac8A8ljp-AA3qoG6_MC6TVFxu0TB66QQhkRJAurrWMUBrXnAzD8dab5KWXrlFLvcbR9jwEC6hu4YGfibR3nYRF

- https://www.mdr.de/nachrichten/deutschland/wirtschaft/unternehmen-verlagerung-ausland-umfrage-energiewende-barometer-100.html

- https://www.mdr.de/nachrichten/deutschland/wirtschaft/solarzellen-meyer-burger-usa-thalheim-schulze-100.html

- https://www.meyerburger.com/pl/produkty-fotowoltaiczne-dla-uzytku-prywatnego

- https://www.mdr.de/nachrichten/sachsen/chemnitz/freiberg/meyer-burger-ende-entlassung-kuendigung-100.html

- https://www.pv-magazine-india.com/2024/11/18/meyer-burger-loses-biggest-customer-questions-business-viability/

- https://www.meyerburger.com/cs/newsroom/artikel/meyer-burger-makes-significant-progress-in-relocating-its-core-business-to-the-usa

- https://obamawhitehouse.archives.gov/sites/whitehouse.gov/files/images/NEC_Manufacturing_Report_October_2016.pdf

- https://businessinsider.com.pl/biznes/volkswagen-w-kryzysie-planuje-ruch-jakiego-w-historii-nie-bylo/z4qkemr

- https://www.dw.com/pl/strajki-i-protesty-w-volkswagenie-zwi%C4%85zkowcy-gro%C5%BC%C4%85-eskalacj%C4%85/a-71007307

- https://fleet.com.pl/news/734-tys-samochodow-mniej-vw-zawarl-porozumienie-ze-zwiazkami

- https://www.autohaus.de/nachrichten/politik/autoindustrie-von-der-leyen-macht-krise-zur-chefsache-3597446

- https://francuskie.pl/stellantis-na-krawedzi-jaka-przyszlosc-czeka-koncern/#google_vignette

- https://www.acea.auto/pc-registrations/new-car-registrations-1-9-in-november-2024-year-to-date-battery-electric-sales-5-4/

- https://www.acea.auto/pc-registrations/new-car-registrations-1-9-in-november-2024-year-to-date-battery-electric-sales-5-4/

- https://thediplomat.com/2024/12/german-carmakers-are-placing-a-risky-bet-on-china/

- https://www.dw.com/en/germanys-mercedes-sees-profits-nosedive-on-weak-china-sales/a-70598243

- https://e-mobilni.pl/mercedes-eqe-chiny-sprzedaz-cena-rynek/

- https://www.bild.de/politik/ausland-und-internationales/eu-will-ploetzlich-vw-co-helfen-auto-wende-6764225f0b31df4fc5339a84?t_ref=https%3A%2F%2Ft.co%2F

- https://www.focus.de/politik/gastbeitrag-von-gabor-steingart-ein-giftiger-cocktail-brodelt-rund-um-die-deutsche-autoindustrie_id_199060378.html)

- https://www.money.pl/gospodarka/rynek-szoruje-po-dnie-zalamanie-uderza-w-polske-7073008871979968a.html

- https://www.automotivelogistics.media/battery-supply-chain/acc-halts-construction-of-two-european-gigafactories/45724.article

- https://www.automotivelogistics.media/battery-supply-chain/acc-opens-gigafactory-in-france-first-of-a-colossal-project/44287.article

- https://www.gramwzielone.pl/magazynowanie-energii/20171233/bateria-sodowo-jonowa-northvolt-tansza-i-bezpieczniejsza-niz-li-ion

- https://elektrowoz.pl/magazyny-energii/northvolt-traci-kontrakt-bmw-na-ogniwa-li-ion-to-powazny-problem-calego-europejskiego-przemyslu-bateryjnego/

- https://www.reuters.com/business/battery-maker-northvolt-makes-progress-toward-longer-term-bankruptcy-financing-2024-12-20/

- https://cleantechnica.com/2024/12/03/lessons-for-europe-north-america-from-northvolt-collapse/

- https://www.powerprogress.com/news/northvolt-ab-files-chapter-11/8042603.article

- https://www.lefigaro.fr/societes/les-etats-unis-nouvel-eldorado-pour-les-entreprises-francaises-20241029

- https://globalbusiness.org/foreign-direct-investment-in-the-united-states-preliminary-1st-quarter-2024/

- https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52024DC0024

- https://www.ft.com/content/49cca8d7-7b6e-47e3-a50c-9557d7c85fc0

- https://www.bankier.pl/wiadomosc/Kapitalizacja-akcji-w-USA-dwa-razy-wieksza-od-PKB-Wskaznik-Buffetta-mowi-ze-ryzyko-inwestycji-w-akcje-staje-sie-ogromne-8852134.html

- https://www.wsws.org/en/articles/2024/12/18/jbnp-d18.html

- https://www.marketwatch.com/story/heres-the-real-reason-europes-top-companies-benefit-from-moving-listings-to-new-york-jpmorgan-says-a2b448ee

- https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52024DC0024

- https://cepa.org/article/across-the-pond-for-profits-european-startups-head-to-the-us/

- https://www.growthnavigate.com/openai-funding-rounds

- https://www.money.pl/gospodarka/europejski-skansen-ostatnie-duze-firmy-powstaly-pol-wieku-temu-7075512431254400a.html

- https://moderndiplomacy.eu/2024/08/27/us-business-migration-grows-europe-loses-top-startups-in-2024/

- https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Government_expenditure_on_education

- https://www.martaprato.com/research, https://intoeurope.eu/deep-dive/europe-is-losing-the-war-for-talent/

- https://en.wikipedia.org/wiki/Fortune_500

- https://intoeurope.eu/deep-dive/europe-is-losing-the-war-for-talent/

- https://codesubmit.io/blog/software-engineer-salary-by-country/

- https://www.ft.com/content/f4fd3ccb-ebc4-4aae-9832-25497df559c8

- https://www.bbc.com/news/business-69004520

- https://www.dw.com/en/china-decries-new-eu-tariffs-on-its-electric-vehicles/a-70637630

- https://www.ft.com/content/f4fd3ccb-ebc4-4aae-9832-25497df559c8

- https://www.lemonde.fr/en/european-elections/article/2024/04/28/european-elections-the-industrial-issue-enters-the-campaign_6669757_297.html

- https://www.rp.pl/polityka/art41550261-umowa-mercosur-ue-final-po-cwierc-wieku-negocjacji

- https://www.gisreportsonline.com/r/implications-eu-mercosur-deal/

- https://biznesalert.pl/macron-skrocona-wizyta-mercosur/

- https://www.gov.pl/web/rolnictwo/zdecydowany-sprzeciw-rzadu-rp-wobec-umowy-ue-mercosur

- https://businessinsider.com.pl/gospodarka/dramatyczne-prognozy-dla-niemiec-tak-nie-bylo-od-100-lat/3l7xf4h

- https://www.tagesschau.de/wirtschaft/konjunktur/umfrage-krise-wirtschaftsverbaende-100.html

- https://www.politico.eu/article/france-germany-fight-over-south-american-trade-deal-mercosur-threatens-eu-rupture/

- https://europa.eu/eurobarometer/surveys/detail/3215

- https://www.dw.com/pl/dexit-afd-chce-by-niemcy-opu%C5%9Bci%C5%82y-ue/a-71124757